November 2022 Florida Housing Market Update

1

2022Caveats for September Statistics

Our November Florida Housing Market update will cover declining closed sales, increasing inventory, and slowing price growth. While these trends have been apparent in recent months, we must take a few factors into consideration when analyzing September statistics. First, Hurricane Ian put the brakes on many transactions throughout the state a week before it made landfall on September 28th. Uncertain as to where exactly Ian's impact would be felt, prospective home sellers and buyers throughout the state put their plans on hold. Many pending transactions were also delayed while buyers waited for insurance companies to resume binding new insurance policies. Second, 2021 was not a typical year. Historically, closed and pending sales slump in September as kids go back to school and the summer buying frenzy fades into the slow season. However, sales remained strong throughout 2021 due to pent-up buyer demand from the pandemic.

Sales Shrinking Below Pre-Pandemic Levels

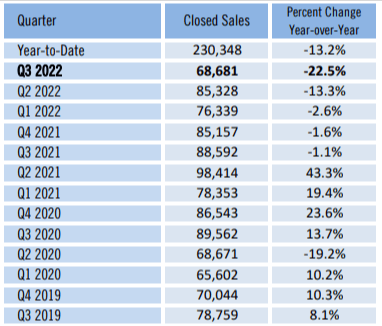

If you have been following our market updates, you have probably noticed that we always warn readers to take 2021-2022 year-over-year statistics with a grain of salt because 2021 was such an atypical year. However, 78,759 Florida single-family homes were sold in quarter 3 of 2019 and only 68,681 were sold in quarter 3 of 2022. This is a 12.8% decline from pre-pandemic sales.

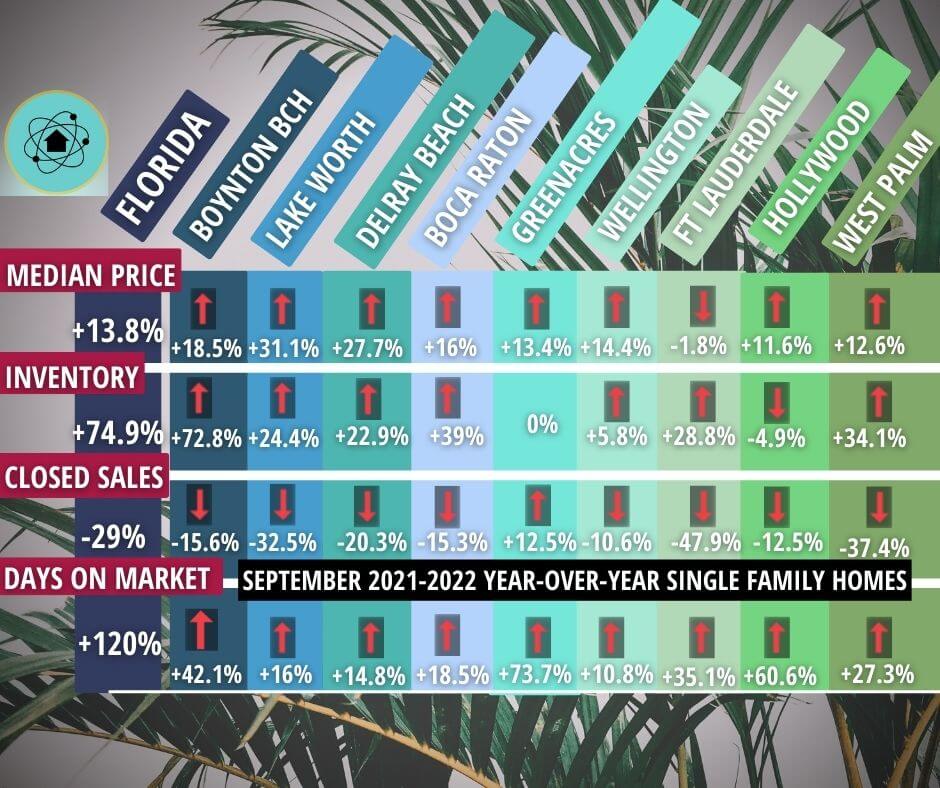

We certainly can't attribute shrinking sales in our November Florida Housing Market update to tightening inventory. Single-family inventory in Florida is up 74.9% year-over-year for September and the median days on the market is up 120%. Again, 2021 was a record-breaking year, but these stats are significant enough to confidently declare that a market correction is underway.

Florida Home Prices on a Downward Trend

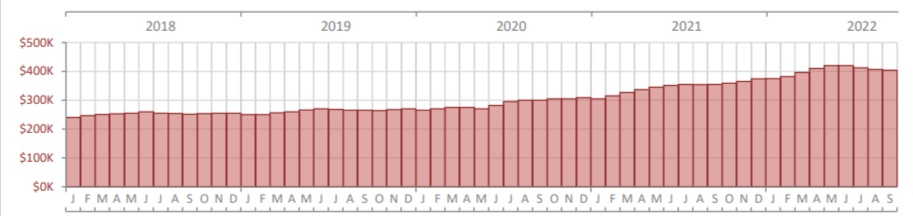

So when will home prices start to fall? Prices are still rising year-over-year in most cities throughout South Florida, but the growth is decelerating. Notably, the median sales price for a Fort Lauderdale single-family home actually fell 1.8% year-over-year in September. The median single-family home price in the Miami-Fort Lauderdale-West Palm Beach Metro Area was $589k in quarter 2 of 2022 and fell to $570k in quarter 3. Of course, prices are still very high compared to pre-pandemic levels. The median price in our metro area was $368,500 in quarter 4 of 2019. While prices are still well above pre-pandemic levels, they are trending toward a more balanced market. The chart below of the median sales price in our metro area signals that the top of the market is probably in our rearview mirror with prices falling for the past three months.

Mortgage Rates Shrinking Buying Power

Many economists expect the Federal Reserve to raise the federal funds rate another 75 basis points on November 2nd. This would be the most significant series of rate hikes in over 30 years. Mortgage rates are currently at the 7% level, but we could hit the 8% mark in the near future. These rates may seem astronomical since we haven't seen average rates above 7% since 2002, but according to Freddie Mac's historical mortgage rate data, the average rate since 1971 is actually 7.76%. Nadia Evangelou, Senior Economist at the National Association of Realtors, makes it clear in an Economists' Outlook blog post that even though interest rates are comparable to historic rates, today's home buyers face greater challenges with housing affordability,

"While inflation outpaces wage growth, the typical family needs to stretch out its budget and spend more than 25% of its income on its mortgage payment. Including other expenses such as mortgage insurance, home insurance, taxes, and expenses for property maintenance, home buying costs exceed 30% of a typical family’s income. Nevertheless, between 1995 and 2002, mortgage payments accounted for 20% of income."

While average mortgage rates are steadily increasing, it's important to remember that mortgage rates vary based on the borrower's credit, down payment amount, loan type, term length, and loan amount. You need to get pre-approved for a mortgage in order to determine your rate and properly budget for a home purchase.

Conclusion

Many potential homebuyers are facing a difficult decision. Should they purchase now before mortgage rates climb even higher or wait for home prices to fall? On one hand, the Florida housing market is shifting toward buyers' favor with month-over-month price decreases, increasing inventory, and longer days on the market. It is likely that the top of the market is behind us and the current trends toward a more balanced market will continue. On the other hand, many economists are predicting further interest rate hikes. If the past few years have taught us anything, it is that the only thing that is certain is uncertainty.

If you're considering purchasing a Florida home, you should get pre-approved so that you can make an informed decision. You may qualify for a rate well below the average and a good loan officer might be able to help you keep your monthly payments affordable with rate buydowns. If you are currently renting, purchasing a home could actually reduce your housing costs given the current rent increases.

If you're looking to retire in Florida, it may be wise to concentrate your home search in the 55 and over sector to protect your investment from a downturn in the near future. The active adult market is less susceptible to market volatility with a steady stream of demand and more cash buyers that are not at the mercy of rising interest rates.