March 2022 Market Report

Real-Ativity

April 25, 2022

9 hours ago

868

0

Apr

25

2022March 2022 Real-ativity Market Report

The latest numbers are in, and the March 2022 Real-ativity Market Report shows conditions that are not sustainable. Closed sales are declining as inventory shrinks, and many potential homebuyers are finding themselves priced out of the market. Home prices are soaring amid record low housing inventory. Interest rates are rising fast, and inflation is at a 40-year high. A market correction is likely on the horizon. The National Association of Realtors chief economist Lawrence Yun expects the market to sway in favor of buyers, “sellers should not expect the easy-profit gains and should look for multiple offers to fade as demand continues to subside.”

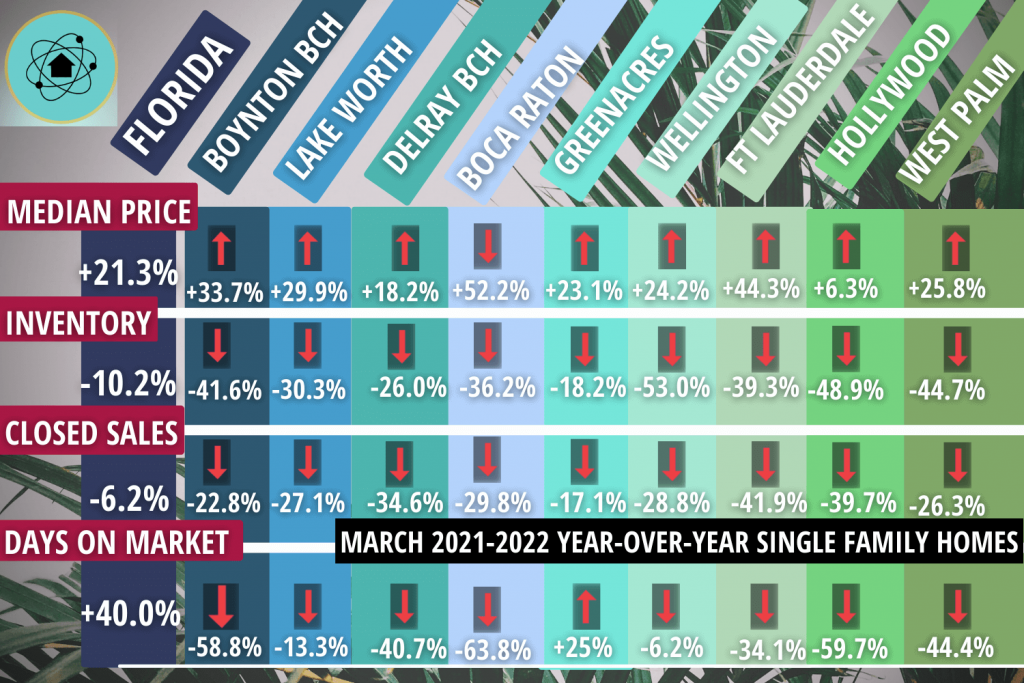

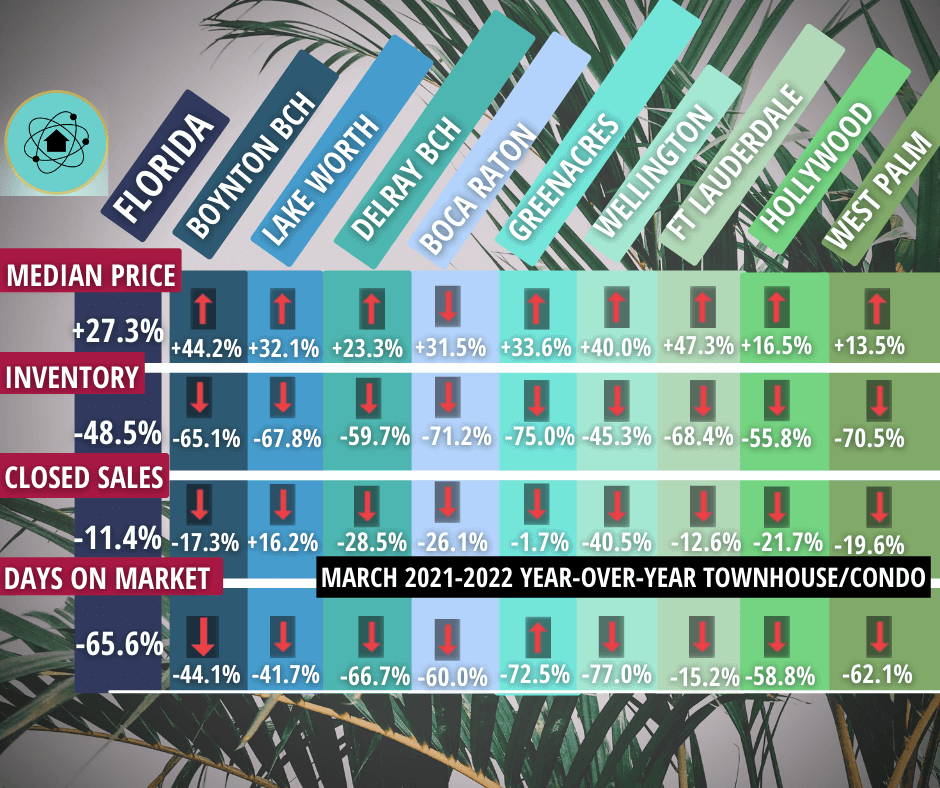

- Florida's spring buying season is here, and the market is showing signs of a slow down from its current frantic pace. Nonetheless, we must use caution when comparing year-over-year statistics because several factors skew the numbers. Last year's buying season was a record-breaker due to pent-up demand from 2020 Covid restrictions, massive relocation spurred by new work from home policies, and very low-interest rates. While people are still relocating to Florida in droves, the pace is decelerating. Year-over-year closed sales were down in March 2022, single-family homes by 6.2%, and condos/townhomes by 11.4%. Let's compare the number of homes with pending sales in the Miami-Fort Lauderdale-West Palm Beach Metro Statistical Area (MSA). We can see that the future decrease of closed sales will continue declining with the pending year-over-year sales down 32.2%.

- The median sales price for condos and townhomes in Florida increased to $308,000, representing a 27.3% year-over-year increase. The median sales price for Florida single-family homes reached $396,558 in March, up 21.3%. The median sales price in the Miami-Fort Lauderdale-West Palm Beach MSA went up 19.1% for all property types year over year. Sales are starting to slow, but limited inventory is keeping prices high. Inventory in our MSA housing market is down 48.2%. The vast majority of the homeowners we speak to are hesitant to list their homes out of fear they will not be able to find an affordable home to purchase.

- Interest rates are rising fast! As of April 25th, the average rate on a 30- year fixed mortgage is 5.31%, the highest average in more than a decade. Interest rates have been steadily increasing week after week since December 23rd, 2021, when the average rate on a 30- year fixed mortgage was 3.05%. The Federal Reserve has penciled in six more rate increases for 2022 to curb inflation. With interest rates up more than 2% in just five months, the number of prospective homebuyers priced out of the market continues to surge. A recent Realtor.com article emphasized the impact of just a 1% rate hike, "While that might not seem like much of an increase, it adds about $375 a month to a buyer’s mortgage payment. Over the life of a 30-year loan, buyers will pay about $135,000 more than they would have just a year ago, assuming they purchased a median-priced home of $392,000 with 20% down and a 30-year fixed-rate loan. The rate changes will cost buyers who take out larger loans even more."

- While there is a great deal of uncertainty in the housing market, the active adult sector tends to offer better stability. With a higher percentage of cash buyers (excluding investors), the active adult sector will not have to bear the brunt of volatility spurred by interest rate hikes. There has been a steady stream of retirees seeking Florida homes, with 55+ communities safeguarded from the heightened demand from millennials working from home. With more even-keeled supply and demand, the active adult sector tends to be a safer investment during market fluctuations.