January 2023 Florida Housing Market Update

1

2023The Real-ativity January 2023 Florida Housing Market Report reveals that inventory is rapidly increasing, price growth is slowing, and closed sales are way down. Understanding our economic landscape requires analyzing national, state, and local economic indicators. Housing Market strength varies widely from one locality to the next, but being aware of the larger economic outlook of the country can provide a clearer view of the horizon.

U.S. Housing Market Update

With key economic indicators pointing in very different directions, economists are at odds over the economy's direction. In early February, the National Association for Business Economics (NABE) surveyed 48 of the leading business economists in the United States. According to NABE President Julia Coronado, "Estimates of inflation-adjusted gross domestic product or real GDP, inflation, labor market indicators, and interest rates are all widely diffused, likely reflecting a variety of opinions on the fate of the economy—ranging from recession to soft landing to robust growth." Despite these mixed predictions, 58% of respondents believe a recession is imminent in the next year.

The National Association of Realtors (NAR) reported home sales declining for the twelfth consecutive month, with a 36.9% year-over-year decrease in January. However, with interest rates trending slightly downward in December and January, the pending home sales index improved by 8.1% month-over-month. While pending home sales show signs of improvement, they are still down 24.1% year-over-year. NAR President Lawrence Yun predicts that "an annual gain in home sales will not occur until 2024." Some economists fear that the political battle over the debt ceiling could push mortgage interest rates up, exacerbating the cooling of the US housing market. Edward Seiler, Associate Vice President of the Mortgage Bankers Association, makes a more optimistic prediction for the 2023 housing market, "Mortgage rates and home-price growth should soften, which, along with cooling inflation, should help bring more prospective buyers into the market during the spring homebuying season."

With mixed results from the Fed's efforts to curb inflation and widespread disagreement over the existence of a looming recession, projections for 2023 mortgage interest rates are all over the board. The rapid rate increases in 2022 from 3% to above 6% demonstrates how volatile interest rates can be. With that said, homebuyers that aren't priced out of the market by interest rates will be pleasantly surprised by the number of homes to choose from. U.S. Housing inventory increased 15.3% year-over-year. With more inventory, homes are taking longer to sell. Only 54% of the homes sold in January were on the market for less than a month. Yun explains the relationship between home prices and days on the market, "Homes sitting on the market for more than 60 days can be purchased for around 10% less than the original list price." With inventory increasing while interest rates curb buyer demand, price reductions on existing listings can be expected.

January 2023 Florida Housing Market Update

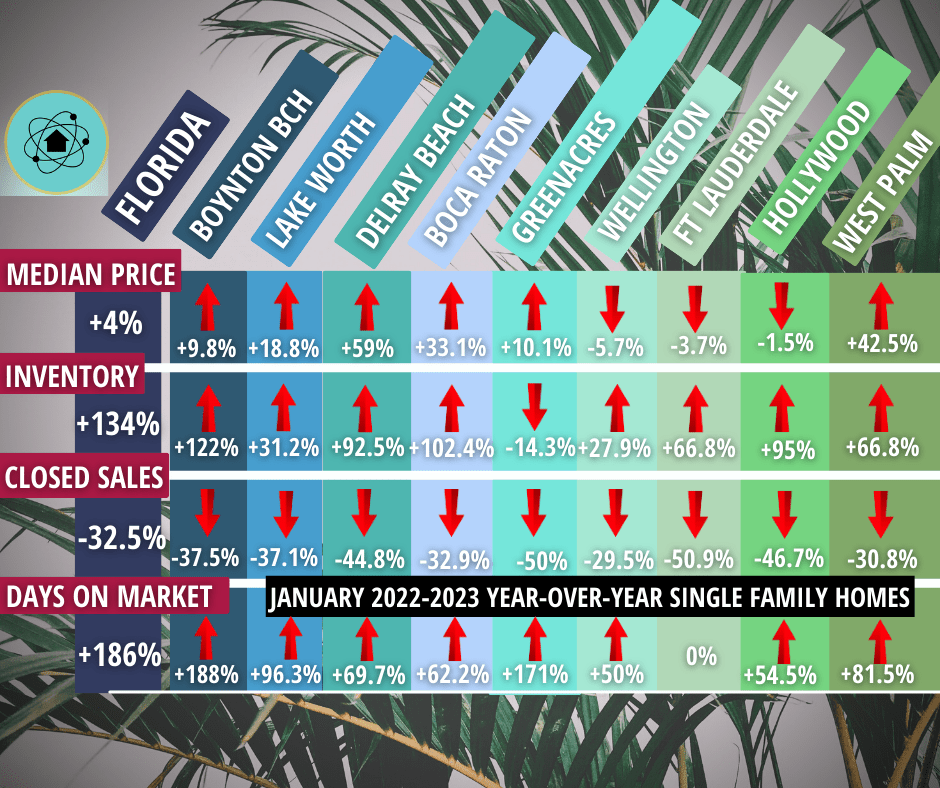

The January 2023 Florida Housing Market statistics follow the trend we saw in the last quarter of 2022, with closed sales way down, inventory increasing, and price growth slowing. Buyer demand has declined in The Sunshine State as mortgage interest rates more than doubled over the past year. Closed sales of existing family homes plunged 32.5% year-over-year in January. We have been advising homebuyers to take year-over-year statistics with a grain of salt because of the pent-up buyer demand from the pandemic. However, single-family home sales were down 4.9%, and condo/townhouse sales were down 9.8% compared to pre-pandemic levels in January 2019.

Inventory in the Florida housing market is skyrocketing. The number of single-family homes listed in January rose a whopping 138% year-over-year. Listing inventory is still not at the pre-pandemic level, but with these sharp increases, we should be there soon. Many Floridians have hesitated to list their primary residence for fear of higher interest rates on their next purchase. However, according to the National Association of Home Builders (NAHB), Florida has the highest percentage of second homes in the country. As of 2020, there were 1.04 million second homes in the Sunshine State, accounting for 10.8% of the nationwide second home stock.

As inventory continues to rise, home prices are starting to fall. The median sales price for single-family homes was $395,000 in December 2022, falling by 1.3% in January 2023 to $389,990. After double-digit year-over-year median sale price increases from July 2020 to November 2022, an increase of only 4% in January 2023 demonstrates a clear price deacceleration in Florida. With the average days on the market up 186%, buyers are gaining more leverage as homes sit on the market longer. It will take some time for buyers and sellers to reach an equilibrium after our unprecedented market conditions over the past few years, but the Sunshine State is headed toward a more balanced market.

South Florida Market Update

The median price in many cities throughout Palm Beach and Broward Counties continues to rise while declining closed sales, skyrocketing inventory, and significant increases in days on the market point to falling median prices in the near future. While Wellington, Fort Lauderdale, and Hollywood had modest decreases in the median sales price ranging from 1.5% to 5.7%. In February, there were price reductions on 2,918 listings in Miami-Dade, Broward, and Palm Beach Counties. To put this in perspective, there were 25,435 total listings in the tri-county area on February 28th. So 11.5% of residential listings in the Miami-Fort Lauderdale-Palm Beach Metro Area had price reductions in February.

We are seeing more favorable conditions for buyers in South Florida. Last year, we could list a home at market value and receive multiple offers well above asking in just a few days. However, the landscape is changing fast in 2023. Listings are taking much longer to sell, leading sellers to reduce their asking price. Buyers are better positioned to negotiate for home repairs and lower prices when homes go under contract.

Aside from what we are seeing on the ground, the Miami-Fort Lauderdale-West Palm Beach Metro statistics also indicate that we are headed toward a more balanced market. The months supply of inventory determines whether a housing market favors buyers or sellers. In January 2022, we had a 1.3-month inventory supply. That number has risen 161.5% to 3.4 months in January 2023. A 5.5-month supply is considered a balanced market, so we are not there yet, but we are definitely headed in the right direction.

Thank you for reading our January 2023 Florida Housing Market Report. Please visit our Featured Cities page for detailed community information and browse listings in South Florida. If you want additional information about purchasing a home in Florida, visit our Smarts tab for home buying tips.