Florida already facing an affordable housing crisis before pandemic hit, evictions inevitable

13

2020Florida was already in the midst of a serious housing shortage long before Covid-19 hit. Rents far exceeded comfortable numbers for most average wage earners. With massive amounts of job loss, the recent end of unemployment benefits and no more stimulus on the horizon renters are sliding further into debt and many have stopped paying rent altogether. The CDC moratorium on eviction will last until the end of the year, afterward where will the tenants go?

Florida Cost of Living Skyrocketing

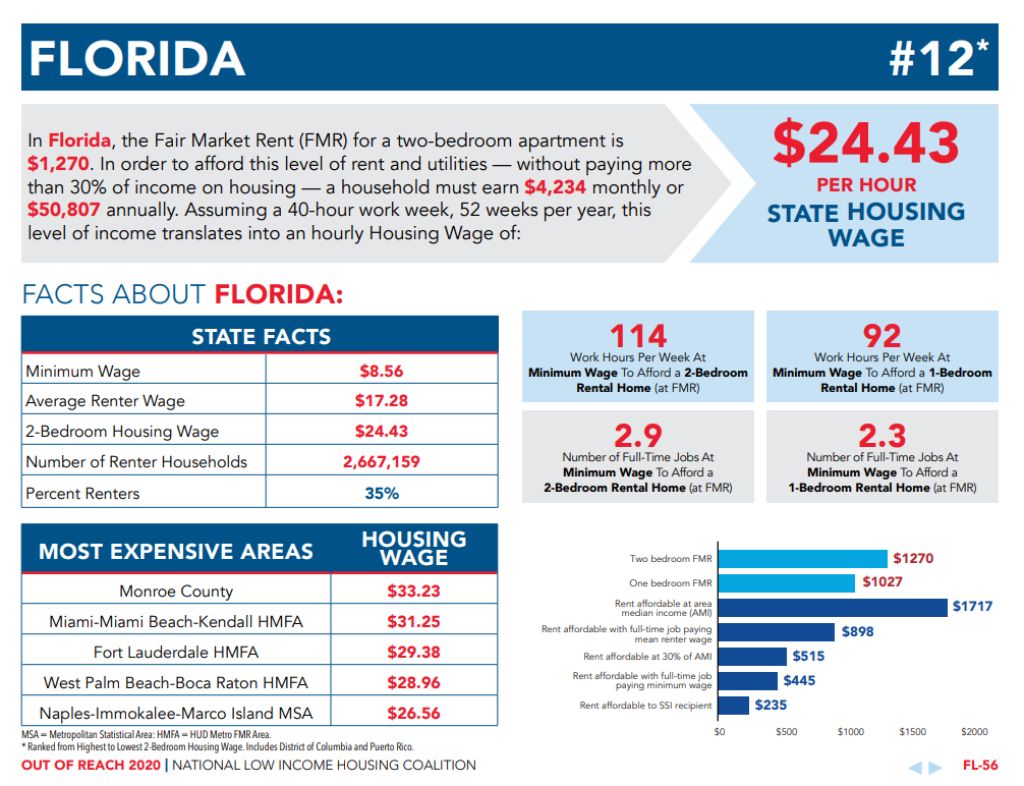

In Florida, the Fair Market Rent (FMR) for a two-bedroom apartment is $1,270. In order to afford this level of rent and utilities — without paying more than 30% of income on housing — a household must earn $4,234 monthly or $50,807 annually. Assuming a 40-hour workweek, 52 weeks per year, this level of income translates into an hourly Housing Wage of $29 per hour in Palm Beach & Broward Counties, the actual average wage is only $19/hr. The minimum wage is much lower, at $8.56/hr, making it necessary for tenants to have to work 2.9 full time jobs at minimum wage to pay the rent. According to the 2020 Out of Reach Report: "If the minimum wage stays this low the rents would have to come down to $515/mo to be affordable."

Florida Facing Housing Shortage

Market conditions, however, have discouraged building or preserving the affordable housing that residents and the economy needed according to a 2019 Miami Herald report: "the state needs more than 790,000 additional homes that are affordable to low-income renters. While the crisis is most severe for low-wage workers and older adults on fixed incomes, households earning up to about $65,000 a year are also under extreme pressure, often living paycheck to paycheck and being forced to choose between food and the mortgage or rent." This is not just a local problem, the nation as a whole is suffering from a rental shortage, according to the National Apartment Association the U.S. needed 4.6 million new apartments before 2030 to meet demand or face a serious housing shortage.

The Covid-19 pandemic has only exacerbated this issue. The National Multifamily Housing Council estimated one out of every three Americans missed a rent payment in April. As of October, 79% of renters were making full or partial payments on their rent nationwide as per a report from the NMHC . Combine that with more than a million jobs lost in Florida from April 2019 to April 2020, according to the Florida Department of Economic Development. The overwhelming majority of the job losses came as the economic shutdowns to battle the coronavirus pandemic grew. Tenants are currently under an eviction moratorium that is keeping them in housing although they are not paying rent, it is set to expire on December 31, 2020.

A Wave of Evictions to Hit Florida

"In light of the CDC’s nationwide eviction moratorium – a policy which will do nothing to deal with the long-term economic pain residents and housing providers are facing - policymakers need to act now to forestall the health and financial crises we are already grappling with from evolving into a housing crisis which would undermine the economic recovery and destabilize the country’s housing market.” Said Doug Bigby, NMHC President. For now, the eviction paperwork is stacking up. Whenever the end of the moratorium happens we should prepare for a wave of evictions.

Rental Assistance for Floridians

If you are a renter seeking help paying your rent here is a list of resources that can help:

- Florida Housing Finance Corporation Governor DeSantis has authorized $120 million of the State of Florida’s Coronavirus Relief Fund (CRF) allocation to Florida Housing Finance Corporation (Florida Housing) to assist Floridians that have been negatively impacted by the COVID-19 pandemic and struggling to pay housing expenses such as: rent, mortgage payments, and emergency repairs that will keep families stably and safely housed.

- United Way’s 211.org

By dialing 211 from any phone or visiting 211.org, you can search by zip code to access a hotline that connects you to emergency rent and utilities assistance, food assistance, relief for “gig economy” workers and contractors, mental health and other supportive services. All calls are confidential, can be made anonymously and callers can request translations services for 180 languages.

https://www.211.org/ - Salvation Army

A searchable database of support services by zip code, city or state. They also offer counselors available via phone (in English and Spanish) to help people connect with local services—844-458-4673.

https://www.salvationarmyusa.org/usn/covid19/ - Catholic Charities

A reliable source of financial support for housing and more. Residents can identify their local chapter to learn more.

https://www.catholiccharitiesusa.org/find-help/ - Unemployment Insurance

If you are eligible for unemployment benefits, this site with help you learn how to apply for them as welfare or temporary assistance and other programs and services.

https://www.usa.gov/unemployment - Resident Relief Foundation

An organization dedicated to helping responsible residents stay in their apartments during an unexpected financial emergency. You can apply for support, but managers can refer residents for financial aid.

https://residentrelieffoundation.org/our-programs/ - Rent Assistance

A directory of rental assistance agencies and organizations that can help residents pay their rent.

https://www.rentassistance.us/ - Community Action Agency

This resource will help residents find out what services they might be able to access locally, such as emergency payment assistance for rent or utilities.

https://communityactionpartnership.com/find-a-cap/ - Help with Bills

Residents can learn about government programs to help pay for home energy bills and other expenses.

https://www.usa.gov/help-with-bills - Grantspace by Candid

Database of national and state grant funds available to help with a wide variety of situations, including special grants for occupations (e.g., nurses, bartenders, hospitality workers, freelancers, first responders) as well as needs (e.g., pet care expenses).

https://grantspace.org/resources/knowledge-base/covid-19-emergency-financial-resources/