December 2022 Florida Housing Market Update

27

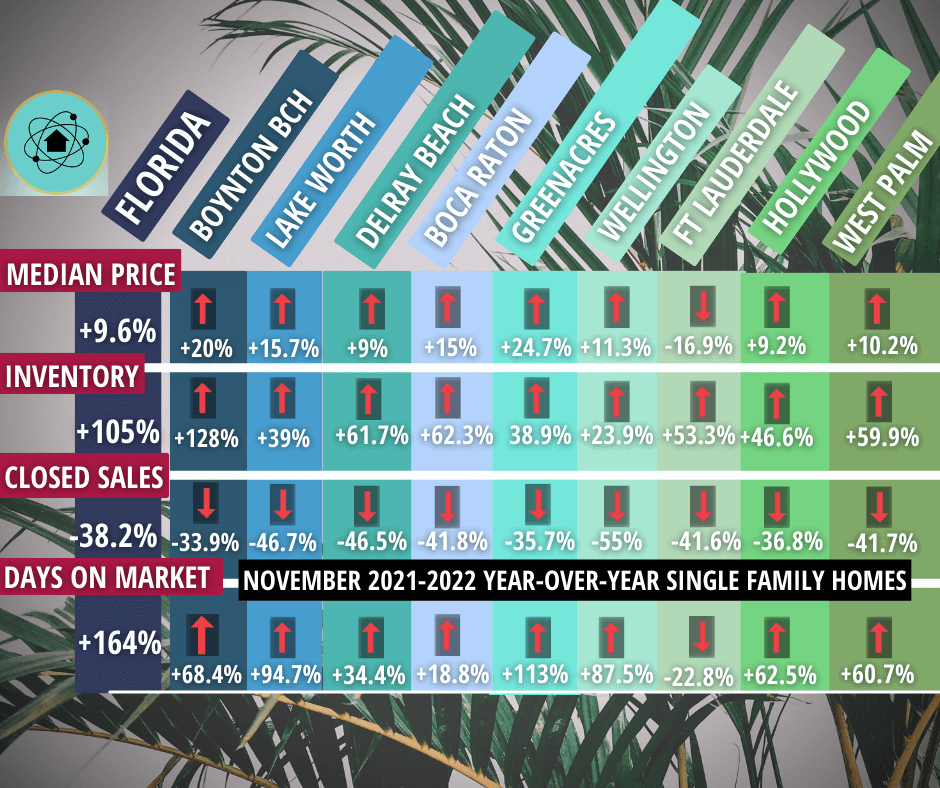

2022In our last housing market update, we discussed tips to combat the home affordability crises. While affordability is still a major roadblock for homebuyers, conditions are slightly improving. The pace of accelerating interest rates is projected to slow in 2023. Meanwhile, the inventory of single-family homes for sale in Florida rose 105% year-over-year in November. Homes are taking longer to sell, prompting sellers to decrease list prices. The median sales price is still up in most South Florida cities as the market struggles to reach an equilibrium between sellers' expectations and buyers' tightening budgets. Buyers' heightened leverage was demonstrated clearly in Miami where 74% of homes sold in November sold below the list price. Furthermore, the median sales price in Fort Lauderdale dropped 16.9% year-over-year.

Mortgage Interest Rates

With the Fed's effort to curb inflation without triggering a recession, 2022 mortgage interest rates have been volatile, to say the least. The average 30-year rate was 3.22% in January before the Fed imposed seven rate hikes throughout the year. However, the December rate hike was 50 basis points, lower than the 75 basis points seen in the last four rate hikes. According to the latest Consumer Price Index, inflation fell from 7.7% to 7.1%. While this is a modest improvement, Bankrate's Chief Analyst Greg McBride states that "the smaller hike reflects the Fed's belief that inflation will continue to moderate." However, Fed Chair Jerome Powell warns us against too much optimism, “Despite some promising developments, we have a long way to go in restoring price stability.”

Fed policy doesn't directly impact mortgage interest rates, but the central bank does affect 10-year treasury yields which do sway mortgage rates. The current national average interest rate on a 30-year fixed-rate mortgage is 6.32%, down from the 7.08% peak at the end of October. It is difficult to predict where mortgage interest rates will go in 2023. The Fed's highest interest rate forecasts indicate rate hikes of 1.25 percentage points. This is way down from the 4.25 percentage points that were imposed in 2022. So while interest rates are not expected to climb at the same rate that we saw in 2022, homebuyers will still see some of the highest mortgage rates in decades.

Home Equity Slipping

Many economists argue that the home equity acquired over the past few years will act as a buffer to prevent a major housing market crash. However, according to Black Knight, homeowners lost 7.6% or $1.3 trillion in equity during the third quarter. This represented the largest quarterly dollar drop in equity in history. While this sounds alarming, Bonnie Sinnock helps us put things in perspective in a recent National Mortage News article, "Overall, at the end of the third quarter, the 50 largest housing markets still had valuations 19% to 66% higher than they were when the pandemic began in 2020. But the speed at which high rates have been eroding the past two years' gains has been notable, with some areas seeing equity reductions of 10% or more since the market peaked."

The Palm Beach County Housing Market is Shifting to Favor Buyers

The November housing market statistics for Palm Beach County indicate that conditions are improving for homebuyers. While the median sales price for single-family homes was up 10.8% year-over-year, the average sales price dipped 5.6%. Closed sales were down 33.4%, and pending sales dropped by 34.1%. Inventory of single-family homes increased by a whopping 113.2%. With sales down and inventory up, sellers are losing their leverage as their homes sit on the market for 36.4% longer than they did last November. Condos and townhomes in Palm Beach County followed a similar trajectory with inventory up 80.6% and the average sales price down 1.5%. While many listings are still overvalued in Palm Beach County, buyers have greater bargaining power as sellers face steeper competition.

Housing Market Conclusion

As the threat of a recession looms, potential homebuyers are wise to approach their purchase with caution. Buying in a 55 and over community is a good way to hedge against the housing market volatility posed by rising interest rates as the active adult sector tends to attract more cash buyers. Focusing on neighborhoods with new development is another way to protect your investment from declining home prices. New amenities in a neighborhood help homeowners retain their equity as buyers are willing to pay more for lifestyle conveniences. A good Realtor can point you toward areas that are less likely to depreciate if or when a recession hits. If you would rather wait until prices fall, rest assured there is hope on the horizon as inventory is rapidly increasing and homes are sitting on the market for longer...prompting sellers to lower their list price.