August 2022 Florida Housing Market Update

1

2022The Recession Debate

Are we in a recession? This fundamental question has gotten quite a bit of media attention lately. While we normally focus solely on the housing market in our monthly market reports, we must address the elephant in the room this month. With the persistent recession debate from experts defending very different opinions, it can be difficult to make sense of our overall economic outlook in order to properly assess the direction of the housing market.

One side argues that the textbook definition of a recession is two consecutive quarters of negative GDP growth, which occurred in the first two quarters of 2022 with a decline of 1.6% in the first quarter and 0.9% in the second quarter. Another argument that we are in a recession or very close to one originates from the yield curve. The yield curve plots the interest rates on short-term and long-term bonds. Normally interest rates are higher for longer-term bonds because investors take a greater risk by tying their money up for a longer period of time. However, when there is an inverted yield curve, the interest rates for short-term bonds exceed that of longer terms. While an inverted yield curve does not always signal a recession, every recession that we have had for the past 50 years has been proceeded by a yield curve inversion. So, many investors on Wall Street are nervous because the yield curve is currently inverted between 2-year and 10-year Treasury notes and the inversion is at its widest point in 22 years.

On the other side of the debate, experts argue that the labor market is too strong to call a recession. According to recent a CNBC article, economic data since 1947 shows " that when gross domestic product has been negative for six months, as is the case for 2022, payrolls fall by an average of 0.5 percentage point. But this year, the job count actually has increased by 1%." Recession naysayers also point to the fact that Americans have more home equity and savings than they did leading up to the Great Recession.

A Housing Market Correction is Underway

No matter what side of the recession debate you find yourself on, it would be difficult to deny that a housing market correction is underway. Home builders and mortgage companies are bracing themselves as home sales decline. A recent survey from the National Association of Home Builders (NAFB) revealed that the inventory of new homes relative to new construction sales was at the highest level since 2010. While buyer traffic to homebuilder websites and sales offices was at the lowest level since 2012. Jerry Howard, CEO of the NAFB expressed his fears that declining sentiment in the homebuilder industry could exacerbate our housing shortage in an August 9th Bloomberg article, "Despite the fact that there aren’t enough housing units in the country, builders are not willing to take the gamble that’s required to build them. They’re afraid that, in a recessionary environment, they won’t be able to sell them." The NAFB estimates that roughly 69% of American households are unable to afford the median price of a new construction home which is currently at $412,505 nationally. This is a great example of our affordability crisis; with the increasing costs for land, labor, and supplies, builders can't afford to build at prices that buyers can afford.

Mortgage companies are struggling to stay profitable as so many buyers have been priced out of the market by soaring home prices and increasing interest rates. The Mortgage Bankers Association recently reported that mortgage applications are at a 22-year low. On August 19th, the market composite index, a measure of mortgage loan application volume, fell 63% compared to the same week in 2021. While refinance applications fell by 83%. There has been a long list of mergers, closures, and layoffs in the mortgage industry this year. Rocket Mortgage, an industry leader, announced it needed to reduce its workforce by 8% after a 94% profit decrease in the second quarter of 2022. Despite these alarming signs, Mortgage Bankers Association executive, Joel Kan expressed optimism in a recent National Mortgage Professional article, “rising inventories and slower home-price growth could potentially bring some buyers back into the market later this year.”

July Florida Housing Market Statistics

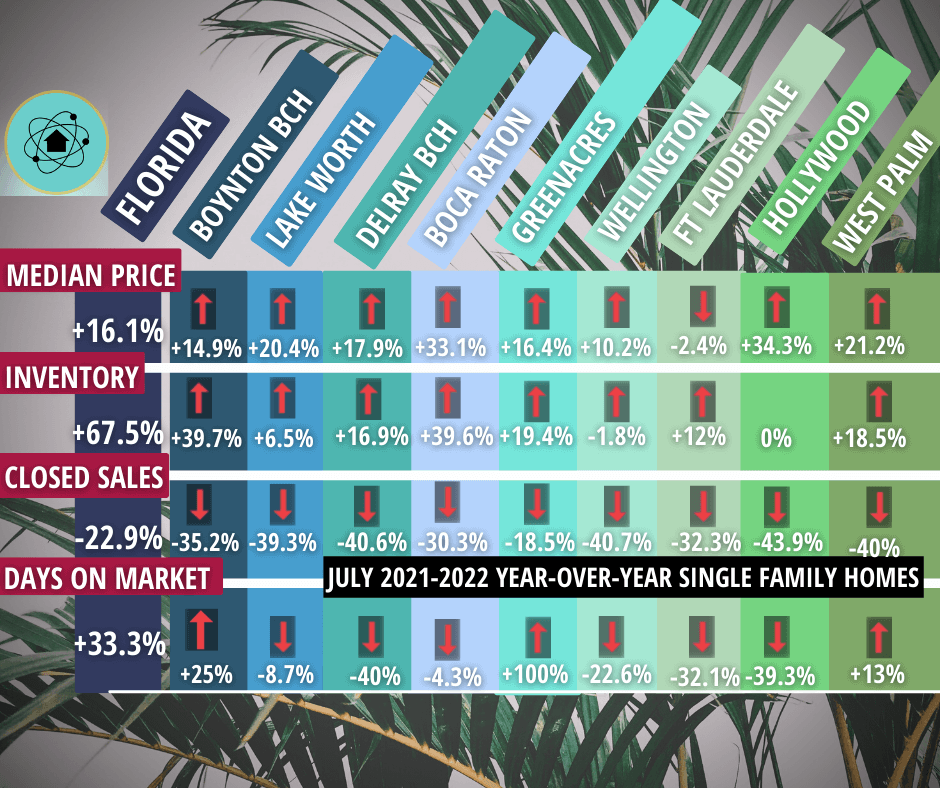

The July housing market report from the National Association of Realtors revealed a 20.2% year-over-year decrease in U.S. home sales and a 6.5% year-over-year increase in inventory. Florida's July statistics are following this national trend with closed sales down 22.9% for single-family homes and 30.7% for condos and townhouses. Of course, 2021 was a record-breaking year with the pent-up demand left over from the pandemic. However, Florida closed sales for July actually dipped below July 2019 levels. The Miami-Fort Lauderdale-West Palm Beach Metro Area saw a whopping 29.5% decrease in closed sales of single-family homes. Another major sign of a Florida market correction is the significant increase in Florida's inventory of homes for sale, surpassing the national average by far, with single-family home inventory up 67.5% year-over-year.

Home prices continue to increase in most South Florida cities, but the rate of growth is slowing. The median price for a Florida single-family home increased 16.1% year-over-year. While still significant, this is the smallest median price increase since January 2021. Fort Lauderdale actually saw a 2.4% decrease in the median sales price with a dip from $615,000 in July 2021 to $600,000 in July 2022. As the market cools, price reductions for active listings are becoming commonplace. In July, 25% of Delray Beach listings, 25.3% of West Palm Beach listings, and 22.3% of Fort Lauderdale listings had price reductions. Of course, this is not to say that homes have stopped selling above the list price in South Florida.

We still have a competitive seller's market with the median days on the market at 14 days in the Miami-Fort Lauderdale-West Palm Beach Metro Area. However, with the months supply of inventory (the amount of time it would take for current listings to sell according to current sales rates assuming no new listings came on the market) up 58.8% year-over-year in our metro area, we can see that the market is shifting in buyers' favor. The market is changing fast, and many sellers are grappling with the idea that they may have missed the opportunity to sell at the top of the market. With the recent influx of price reductions on active listings, sellers are starting to come to terms with the reality of our changing market. Many Florida home buyers have been priced out by rising interest rates and skyrocketing home prices. As demand cools, prices should start to normalize from the over-inflated levels over recent years. While there is always demand from out-of-state buyers and retirees looking to relocate to the Sunshine State, there is hope on the horizon for buyers who have been waiting it out to avoid bidding wars that often result in paying well above appraisal price.