Are Mortgage Delinquencies a sign of looming market change in Florida?

13

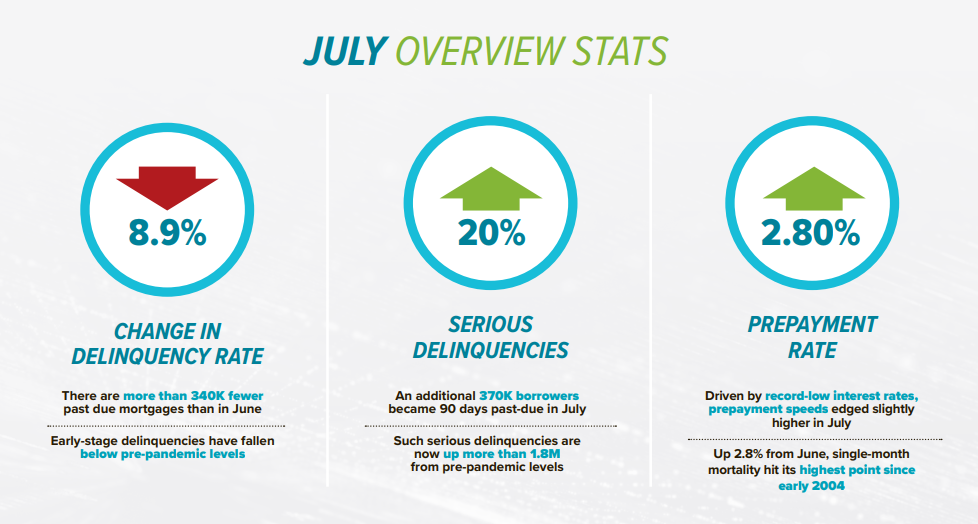

2020Mortgage delinquencies are one of the biggest issues facing the South Florida real estate industry. We have 389,000 Florida mortgages over 90 days delinquent. This is a massive indicator of market change.

Mortgage Delinquencies & Florida Unemployment

According to a report by real estate data analytics firm Black Knight, Florida’s 10.52% May mortgage delinquency rate was fifth-highest in the United States. Florida’s 14.5 percent May unemployment rate is likely a significant contributor to increased loan delinquencies and an indicator of consumer ability to catch up on the past due payments. People who lost their jobs to the Covid-19 pandemic and stopped paying on their mortgage are unlikely to find gainful employment in the current environment.

Although the Cares Act opened the gate for forbearance programs the sheer volume of mortgage delinquencies across the nation is staggering, it begs the question: "will consumers have the money to catch up on past payments and interest in one lump sum as so many mortgage servicers are asking?"

Florida Economy Hit Hard by the Pandemic

In comparison to the U.S. overall, 4.3 million homeowners were past due or in active foreclosure in May, pushing the national delinquency rate to 7.8 percent, Florida for its part tends to stand out in these times due to the high cost of living, the high price of real estate, relatively low wages and economy heavily based on hospitality and tourism.

For their part, Covid-19 travel restrictions, both to and from the United States are also helping to keep tourism dollars out and international real estate business is suffering. According to a report from National Public Radio: "60% fewer people traveled to Florida compared to the same period a year earlier. That's a decline of almost 20 million visitors."

The future of sunny South Florida seems like it may be less than bright for the coming few years as Florida ended its fiscal year with a $1.9 billion shortfall in forecasted revenues.

According to Black Knight: "What remains to be seen is what impact the new spikes in COVID-19 around much of the country will have on forbearance requests moving forward. If they lead to another round of shutdowns – or extensions of those already in effect – and put upward pressure on unemployment numbers, we could see yet another reversal of this trend. The same holds true for the looming expiration of expanded unemployment benefits."