April 2022 Market Report

1

2022April 2022 Market Report

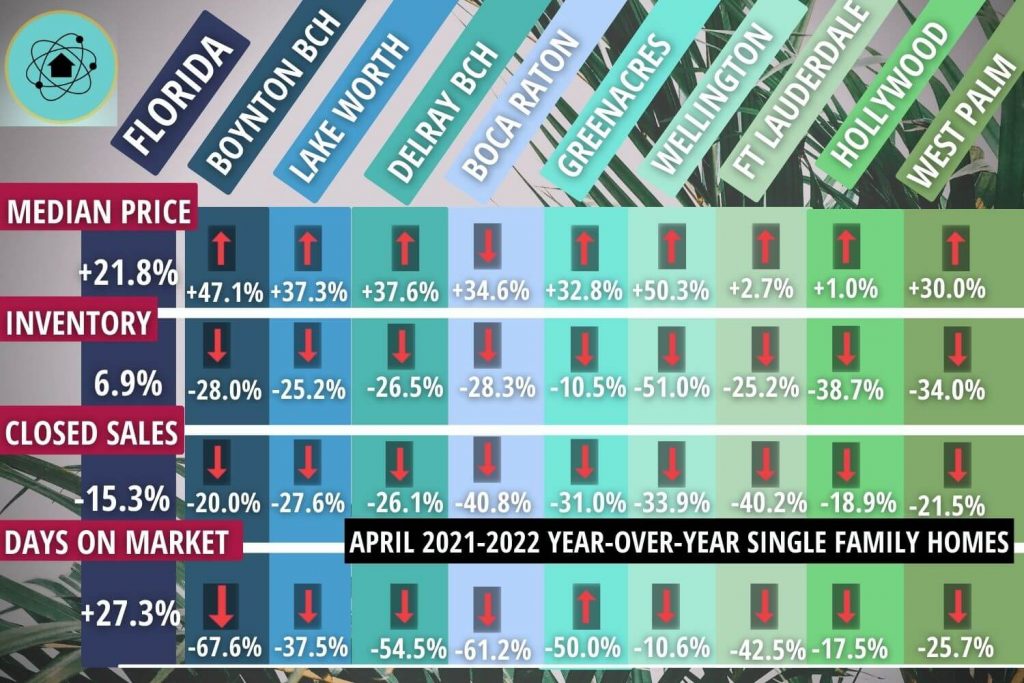

Our latest April 2022 Market Report illustrated Florida home sales declining for the 3rd month. Closed year-over-year sales were down 20.8% for the Miami-Fort Lauderdale-West Palm Beach Metro Statistical A a. Pending sales were also down 21.3% compared to April 2021. With inventory down 9.9% from last year, when inventory was already incredibly scarce, this decrease in home sales is likely due to the continued lack of homes for buyers to purchase. While many buyers continue to get priced out of the market by skyrocketing home prices, rapidly increasing mortgage rates, and an annual inflation rate of 8.3%, the remaining buyers face stiff competition with limited inventory. As a result, prices continued to increase, with the median sales price up 19.8% year-over-year in April.

Some experts are predicting more favorable conditions for buyers on the horizon. Craig Lazzara, S&P DJI managing director, warns that "The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer. We may soon begin to see the impact of increasing mortgage rates on home prices." Redfin's chief economist Daryl Fairweather echoes this sentiment. In the four weeks leading up to April 3rd, 12% of homes listed on Redfin reduced their original list prices. Fairweather reflected on these price reductions, "It goes to show that there's a limit to sellers' power. There is still way more demand than supply, and buyers are still sweating, but sellers can no longer overprice their home and still expect buyers to clamor at their door."

While the demand in South Florida is still supporting a strong seller's market, these conditions are not sustainable. "Eventually, mortgage rates will slow down home prices, but it hasn't happened so far," says Ken H. Johnson, an economist at Florida Atlantic University. "We should not see rapid upticks in prices as mortgage rates rise. It's that kind of exuberance that led to past housing downturns." Prices are still high in Palm Beach County, but inventory is improving, which is the crucial prerequisite for a much-needed market correction. President of the MIAMI Association of Realtors's Jupiter branch, Brad Westover, anticipates better days for South Florida Buyers. "Palm Beach real estate remains in a high-demand/low supply market, but more inventory is showing signs of coming to the market," Westover said, "Palm Beach single-family home active listings were down just 2.5% year-over-year in April 2022, a good sign as higher rates are expected to increase days on market in the months ahead."

Are you looking to retire in Florida? It may be wise to concentrate your search specifically toward 55+ communities. Doing so could protect your investment from a potential downturn soon. The active adult market is less susceptible to market volatility with a steady stream of demand and more cash buyers that are not at the mercy of rising interest rates. Check out our Insights tab for more information.